Ky Gambling Tax

BOWLING GREEN, Ky. (AP) — A Kentucky man has been sentenced to one year and three months in prison for operating an illegal gambling operation on the internet.

The Daily News reports Douglas Booth was sentenced Wednesday in Bowling Green federal court after reaching a plea agreement on charges including failing to file tax returns and money laundering.

Booth, 50, controlled websites hosted in Costa Rica on which illegal gambling on sporting events took place, according to court filings.

Kentucky’s then-Governor Steve Beshear (Andy Beshear’s father) obtained legal permission to seize 141 online gambling domains at that time, including PokerStars, and the case continued as Kentucky demanded money from PokerStars for taking rake from losing players located in Kentucky from 2008 to 2011 when PokerStars left the US market. Kentucky Problem Gambling Resources in Kentucky. If gambling is causing a problem in your life we encourage you to ask questions, gather information and conduct research on the type of help that is most appropriate for your situation. This information is intended to be a starting point—it is not a complete list of information or services.

Booth’s plea agreement said he received about $2.3 million from his gambling operation that he laundered through banks, real estate property purchases and loan payments.

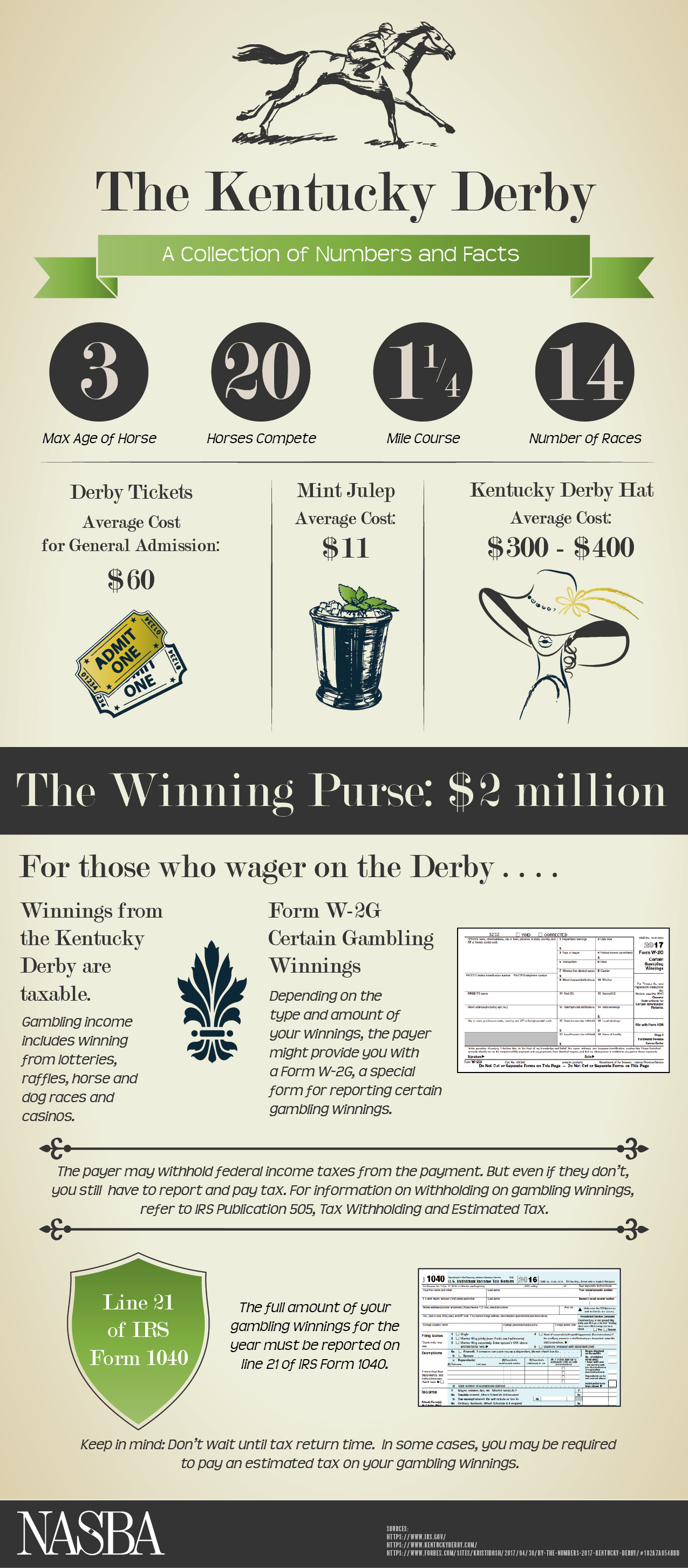

Although the tax changes brought about by HB 487, Kentucky’s sweeping tax reform bill, were first enacted on Apr. 27, 2018, many horseplayers and tax professionals are just now becoming aware of. Like all states, any winnings earned while gambling in Kentucky will be subject to a flat Federal rate tax of 24%. For winnings that exceed the value of $5,000, a state tax rate of 6% will be added, creating a total liability of 30% overall.

Attorney Harris Pepper has admitted taking part in the money laundering conspiracy, receiving about $200,000 from Booth in cash and relief from gambling debts.

Pepper was fined and put on probation for five years at his sentencing earlier this month.

Introduction to Kentucky Slot Machine Casino Gambling in 2020

Kentucky slot machine casino gambling does not include games of chance, which are strictly illegal. Instead, Kentucky has competition-based electronic gaming machines at four out of its five pari-mutuel wagering racetracks.

Theoretical payout limits are not available but monthly return statistics are available for electronic gaming machines.

This post continues my weekly State-By-State Slot Machine Casino Gambling Series, an online resource dedicated to guiding slot machine casino gambler to success. Now in its third year, each weekly post reviews slots gambling in a single U.S. state, territory, or federal district.

Keep Reading … or Watch Instead!

Or … Listen Instead!

Subscribe to my Professor Slots podcast at Apple Podcasts Google Podcasts Spotify Amazon Music Amazon Audible Gaana Stitcher Pandora iHeart Radio Tune-In SoundCloud RadioPublic Deezer RSS and everywhere else you find your podcasts!

Relevant Legal Statutes on Gambling in Kentucky*

The minimum legal gambling age in Kentucky depends upon the gambling activity:

- Land-Based Casinos: Not available

- Poker Rooms: Not available

- Bingo: 18

- Lottery: 18

- Pari-Mutuel Wagering: 18

Kentucky’s interpretation of legal gambling requires the competitor’s level of skill “must sufficiently govern the results.”

Therefore, competition-based games are legal as well as pari-mutuel wagering. Traditional slots are illegal, including those referred to as Class III, Vegas-style, and games-of-chance slot machines.

Kentucky has competition-based electronic games available in a few of their pari-mutuel facilities. These skill-based games are anonymously-based historical race results.

Historically, Kentucky has had a fascinating relationship with gambling. While casino gambling was never legal, gambling dens were prevalent before the Great Depression of 1929. To this day, the open display of illegal gambling from that time in American history continues to negatively affect the perception of gaming in Kentucky.

If you’re ever in Newport, directly across the Ohio River from Cincinnati, consider walking the Newport Gangster Tour.

*The purpose of this section is to inform the public of state gambling laws and how the laws might apply to various forms of gaming. It is not legal advice.

Slot Machine Private Ownership in Kentucky

In Kentucky, it is legal to own a slot machine privately.

Gaming Control Board in Kentucky

The Kentucky Horse Racing Commission (KHRC) regulates skill-based games at pari-mutual racetracks in the Commonwealth of Kentucky.

These devices are Historic Horse Racing (HHR) electronic gaming machines. The KHRC reports Kentucky offers 2,981 HHR machines.

Casinos in Kentucky

There are five pari-mutuel racetracks in the Commonwealth of Kentucky. Of these, only four sites offer skill-based HHR electronic gaming machines.

The largest casino in Kentucky is Derby City Gaming with 1,000 HHR gaming machines.

The second-largest casino is Red Mile Gaming & Racing, an HHR parlor in partnership with Keeneland Race Course, with 938 gaming machines.

Commercial Casinos in Kentucky

The four out of five of Kentucky’s pari-mutuel racetracks with skill-based HHR electronic gaming machines are:

- Derby City Gaming in Louisville located 74 miles west of Lexington on the Indiana border.

- Ellis Park Racing and Gaming in Henderson located 105 miles northwest of Bowling Green.

- Kentucky Downs Gaming in Franklin located 29 miles south of Bowling Green.

- Red Mile Gaming & Racing in Lexington.

Tribal Casinos in Kentucky

The Commonwealth of Kentucky has no federally-recognized American Indian tribes and, therefore, no tribal casinos.

Ky Gambling Tax Exemption

Other Gambling Establishments

As an alternative to enjoying Kentucky slot machine casino gambling, consider exploring casino options in a nearby state. Bordering Kentucky is:

- North: Indiana and Ohio Slots

- East: West Virginia Slots

- Southeast: Virginia Slots

- South: Tennessee Slots

- West: Missouri Slots

Each link above will take you to my blog for that neighboring U.S. state to Kentucky.

Our Kentucky Slots Facebook Group

Are you interested in sharing and learning with other slots enthusiasts in Kentucky? If so, join our new Kentucky slots community on Facebook. All you’ll need is a Facebook profile to join this closed Facebook Group freely.

There, you’ll be able to privately share your slots experiences as well as chat with players about slots gambling in Kentucky. Join us!

Payout Returns in Kentucky

The Commonwealth of Kentucky does not offer any theoretical payout limits for their competition-based HHR gaming machines.

Ky Gambling Tax Rates

The Kentucky Horse Racing Commission offers statistics for HHR gaming under Quick Links entitled Wagering on Historical Horse Races. Its December 2019 report indirectly offers actual return statistics including comparisons to past actuals.

To calculate a player’s win percentage from the report, divide Less: Return to Public by Total Handle. For December 2019, the monthly Player’s Win% for HHR machines were:

- State-wide: 91.5%

- Derby City: 90.9%

- Ellis Park: 93.9%

- Keeneland/Red Mile: 91.3%

- Kentucky Downs: 92.0%

From this December 2019 report, Ellis Park had the highest player win% at nearly 94% while Derby City had the lowest at nearly 91%.

Summary of Kentucky Slot Machine Casino Gambling in 2020

Kentucky slot machine casino gambling exists as competition-based, games-of-skill Historical Horse Racing (HHR) electronic gaming machines instead of games-of-chance slot machines.

No minimum or maximum theoretical payout limits have been set. Monthly return statistics are publicly available for each pari-mutuel racetrack with HHR games.

Annual Progress in Kentucky Slot Machine Casino Gambling

In the last year, Kentucky increased its HHR machines by 9% to 2,981 devices. However, the average daily handle for HHRs increased by 46%. For 2020 so far, it’s an amazing 59% increase compared to 2019.

Other State-By-State Articles from Professor Slots

Ky Gambling Tax Rate

- Previous: Kansas Slot Machine Casino Gambling

- Next: Louisiana Slot Machine Casino Gambling

Ky Gambling Age

Have fun, be safe, and make good choices!

By Jon H. Friedl, Jr. Ph.D., President

Jon Friedl, LLC